Sustainability and responsibility are core values of eQ Plc and integrated deep in the operations of eQ Asset Management Ltd and Advium Ltd, the corporate finance arm of eQ Group.

Sustainability is a key element in investment operations and their processes

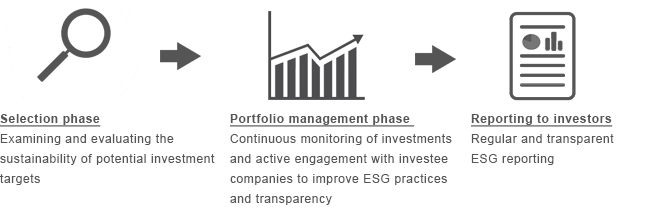

In practice, this means that sustainability and ESG (environmental, social and governance) analysis is an essential part in the security selection and portfolio management of the investments, and ESG reporting is included in our regular performance reporting in all asset classes. eQ’s Director for Responsible Investment Sanna Pietiläinen is responsible for coordinating this work. All our portfolio managers and analysts understand, recognize and take into account the potential sustainability risks and opportunities pertaining to investments. This core element in our investment processes cannot be outsourced. Therefore, we have invested in developing internal ESG resources systematically over several years and enhancing an open culture to share best practices between professionals across all asset classes and investment styles.

Responsible Investing at eQ Asset Management

Selection phase

Including sustainability matters in all our asset classes (equity and fixed income investments, real estate and private equity) is very down to earth and part of the portfolio manager’s day-to-day work when selecting investments and managing funds. We aim for outstanding long-term return. Responsible and sustainable operations are fully in line with this goal, and that is why ESG analysis is a key element in the investment processes of all our funds. Since 2018, our own sustainability assessment work has been supported by ISS-Ethix, which monitors the contents of our equity and fixed income funds quarterly to detect any violations of the UN's Global Compact principles.

Portfolio management phase

Our portfolio managers and analysts continuously monitor investments and engage with investee companies whenever necessary to increase our understanding and to promote reasonable transparency of ESG issues in company reporting globally. Our own proprietary data and ISS-Ethix's screening results are used actively in the dialogues with companies, and in all serious violations, we will launch a separate internal follow-up process in order to find out if the investment is still in line with our responsibility principles for long-term ownership. Our engagement policy, which is revised and approved annually, also allows us to enter into collective engagement with other investors when necessary.

ESG reporting

We provide regular ESG reporting to our clients regarding all our asset classes.

Co-operation with Baltic Sea Action Group

Late 2018, eQ Asset Management and Baltic Sea Action Group (BSAG) launched a cooperation enabling Baltic Sea protection combined with fund investing. Baltic Sea Action Group is an independent, non-profit foundation aiming for the improvement of the state of the Baltic Sea and climate change mitigation. BSAG aims to identify and provide matchmaking support for all relevant actors to protect the Baltic Sea and acts as a catalyst for beneficial cooperation.

BSAG and eQ believe in innovative solutions in combating environmental challenges and aim for leadership in protecting our vital environment. The financial model created in cooperation with eQ is an example of such an open-minded initiative – a fund investment simultaneously becomes an investment in a good cause benefiting all. For BSAG, this opens two alternatives for supporters of BSAG - invest or donate. eQ pays 85% of the management fee of the BSAG share series in the eQ Blue Planet Fund to BSAG.

BSAG and eQ believe in innovative solutions in combating environmental challenges and aim for leadership in protecting our vital environment. The financial model created in cooperation with eQ is an example of such an open-minded initiative – a fund investment simultaneously becomes an investment in a good cause benefiting all. For BSAG, this opens two alternatives for supporters of BSAG - invest or donate. eQ pays 85% of the management fee of the BSAG share series in the eQ Blue Planet Fund to BSAG.

Read more about eQ’s sustainability

- Responsible investment policy

- Ownership policy (only in Finnish)

- Statement on the principal PAI of investment decisions 30.06.2024

- Statement on the principal PAI of investment decisions 30.06.2025_eQ Fund Management Company Ltd

- eQ Group's Sustainability Report 2024

- Private Assessment Report 2024 - eQ Asset Management Ltd

- Public Full Transparency Report 2024 - eQ Asset Management Ltd

- Fund-spesific ESG reports (only in Finnish)

We regularly report to PRI (UN’s Principles for Responsible Investment) on sustainability in our investment processes, our concrete impact activities in the investments and our development initiatives regarding our responsible investment approach and processes. The table below shows the ratings for our PRI reporting in 2024.

*PRI reporting scale: 1 star "poor" - 5 stars "best".

For more information, please contact:

Sanna Pietiläinen

Director, responsible investment

+358 44 906 0885

sanna.pietilainen(at)eq.fi

LinkedIn